Saving for travel, to buy a house, to start a family or just for the sake of saving doesn’t have to be something that is unattainable and impossible. Everyone’s saving capabilities will be different due to their income and individual circumstances. Despite this, I believe that almost everyone should be able to at least save some sort of money by prioritising the important aspects of their lives and making some committed changes to their habits.

Having existing debt and liabilities will make this a little more difficult, and a slightly lengthier journey, but it does not necessarily mean it is impossible. You may just need to be a little bit smarter with where your money is going and what you are paying off first. But please don’t be deterred from achieving your savings goals.

Realising Your Savings Potential

Where is All the Money Going

For me, I decided that I was sick of wasting all of my hard earned money on material possessions and short lived experiences that weren’t really that valuable or important to me in the long run. I started thinking about how I was spending my money and what I was spending it on. After that, I worked out what I would rather be spending it on.

I realised that none of my money was going towards making me happy in the long term. The small bursts of endorphins I was receiving from my everyday spendings weren’t leaving a lasting effect. I knew I had to make a change. Taking this honest look at my spending and saving habits allowed me to work out how to reduce the amount of money I was wasting. I could then redirect it to something more useful that was in line with my goals and dreams.

Steps that Worked for Me

These are the steps I followed to bring my savings goals to fruition and I’m hoping that they will help you to do the same. I am not a financial adviser and there are likely one thousand approaches out there to saving money, but this is just the process that I live by and that works for me. I managed to save more than half of my annual income last year by following these steps. As a result of that I was able to travel for six months without working.

The following information is based on my own experiences and is a process that I use to save money and reach my savings goals. I am not a financial adviser and am not providing financial recommendations in this post. It is my intention to give you some handy tips, tricks and steps to assist you in reaching your savings goals. You should consider your own circumstances and make the decisions that are right for yourself.

Step 1 – Work Out What You Spend Your Money On

Write it all down. Write down every single one of your living costs and expenses. Be brutal and scrupulous. Go through your bank statements and work out all of your fixed and regular payments. Then work out how much you are spending on everything else on average. Try to be as honest as possible in this step. You need to ensure you don’t miss anything.

Work out how much you spend in a fortnight on average on all of your living costs including alcohol, food, coffee, going to the cinemas, taxi’s/ubers, clothes, shopping and any other variables. Add that in with all of the fixed payments that regularly come out of your account and then work out your total expenses. This may be a daunting process, but it gets less scary after this.

Step 2 – Break Your Spendings Down into Categories

There are usually three categories of expenses that I like to think about when trying to work out a savings plan. Compulsory, Flexible, and Non-Essential.

First of all, I look at the costs that are compulsory and unavoidable. These are usually hard to reduce and almost impossible to eliminate. The next category of expenses are the flexible costs. These are costs that you may not be able to avoid entirely, or don’t necessarily want to, but that you can reduce or be more mindful of. Complacency and ignorance can be very expensive when it comes to finances.

The final category is costs that are non-essential and can be eliminated entirely. You may not be able to eliminate them altogether all of the time, but becoming aware that there are costs in your life that don’t need to be there will make you a lot more aware and cause you to think twice next time you go to waste money.

Step 3 – Work Out the Compulsory Costs

As I mentioned, you need to go through your list of expenses and work out all of your compulsory costs. This is usually costs relating to medical bills, medication or sometimes rent. Your individual situation will dictate whether or not a cost can be reduced or eliminated, but you need to make sure you only put expenses into this category that are genuinely compulsory. You will only be damaging yourself if you aren’t up front and honest in this step.

Some people will have more of these kinds of costs than others and the odds are that when you first take a look at your finances you will put a lot of expenses into this category and then later realise that you can actual reduce them. From there you can move them to the flexible or non-essential costs categories. Identifying what expenses are within your control and what are outside of your control are crucial to saving money.

Step 4 – Work Out the Flexible Costs

A Complete Overhaul

This next step involves working out all of the expenses in your life that you could possibly reduce. A lot of people have phone plans, internet plans, streaming services, music services, and various other memberships and accounts that they are paying way too much money for. You may not want to move an expense into the category where it is totally eliminated from your life because you might need it, such as internet, or car insurance. But it doesn’t mean that you should be letting your contracts renew without looking into whether there are cheaper options out there for those services and products.

The Small Costs Add Up

Once you look at how you can reduce the costs of these expenses you may find that you can also eliminate some of them entirely by downsizing the number of accounts or memberships you have. Some people start two or three different streaming services and think that just because they are only $10-$15 per month each that it doesn’t matter how many you have or that you are spending your money on them.

Those little costs may seem small when you look at them on their own but they begin to add up over the term of the contract. In combination with the several other small fee expenses you have in your life they can become quite significant. This was one of the major areas where I was able to save a lot of money initially when I started my savings plan.

Step 5 – Work Out the Costs that Can Be Removed Entirely

Breaking the Habit

This is usually the most difficult step for people to grasp and follow through with. A lot of us have grown very accustomed to the extra little things in our lives. We find it quite difficult to part ways with them. When you actually take the time to write down how much money you are spending on non-essential costs such as coffees, takeaway, alcohol, transport, new clothes, electronics and homewares you start to realise how quickly these expenses can add up. If you are really committed to the cause and need to save a lot of money in a short amount of time then this is by far the easiest way to reduce your expenses and maximise your savings. It is also an excellent way to de-clutter and de-complicate your life.

The Benefits

By cutting out all of the non-essential expenses in your life you are able to very easily see how much money will be coming in and out of your account each fortnight. It also means that all of those extra expenses that you don’t need to live and function are being channelled towards your short and long term goals. This level of commitment can be hard to maintain, and you do need to get creative in finding free or cheap ways to still have a social and enjoyable life in the meantime, but it is not impossible.

Even if you don’t want to cut out all of these extra expenses entirely, just reducing some of them will make a difference. The mere fact of being aware of these habits will make a difference. Identifying them and knowing what you would rather be spending your money on means that the next time you go to make a purchase on one of these items or experiences, you can make a more informed decision about whether it is what you want to spend your money on. With this thought process in place you will be less likely to spend your money so haphazardly. You will automatically start saving money and become closer to your savings goals.

Step 6 – Set Your Savings Goals

Why it is Important to Set Savings Goals

So once you have done all of this, and are ready to put your new plan into action you need to set yourself some goals. The goal itself isn’t entirely important for reducing your spendings, but it is an excellent mental boost when you are struggling to maintain your new savings lifestyle. Seeing the progress you make each fortnight, compared to the realistic savings goals you set in the beginning is very reassuring and encouraging. It can also be the motivation you need if you start falling behind on your savings goals.

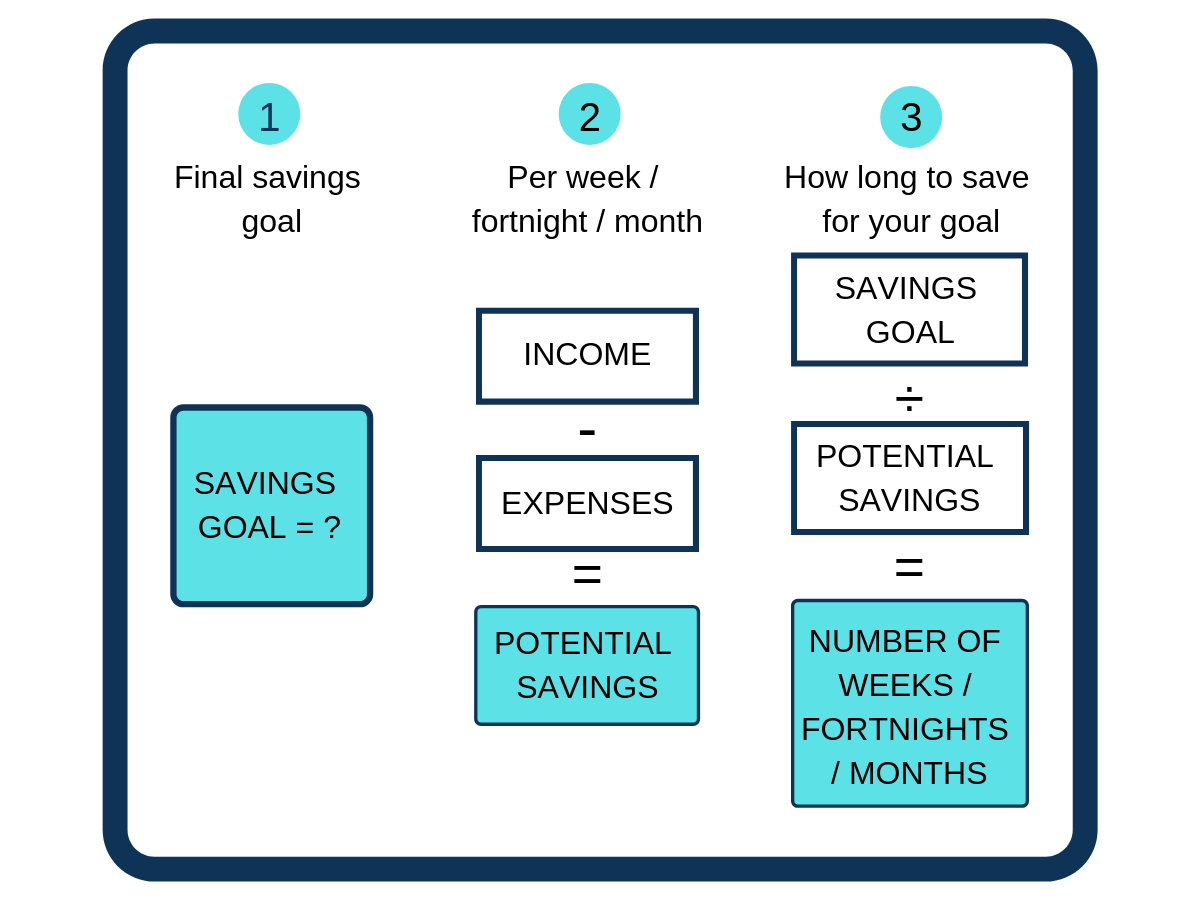

How to Work out Your Savings Goals

Most of the time you will have a specific amount in mind for whatever it is that you are saving for. You need to work out your savings capabilities to then determine how long it will take to reach that savings goal.

Once you have worked out all of the three categories above, have reduced your flexible costs, and have eliminated a significant amount of the unnecessary costs then you can determine how much you are spending each fortnight. Take this amount way from your fixed or average fortnightly income and you should know exactly how much you will be able to save as a minimum. You then need to divide your savings goal by that fortnightly savings capability and you will be able to determine how many fortnights it will take you to reach your savings goal.

From here, you can start putting together a spreadsheet to work out your forecasted savings for each fortnight. Now you have a realistic savings plan, fortnightly goals and a major goal to hurdle yourself towards. This will make the whole process a lot easier.

Then at the end of each fortnight you can enter in how much you actually saved. You will either be pleasantly surprised that you exceeded your savings goal, or realise that you need to be a little more committed to your cause. Having a record like this really makes you accountable for your spendings. It makes your goals and achievements a lot more clear and tangible as well.

Change the Way You Organise Your Accounts

It can also make it easier if you have separate bank or sub-accounts. You could have a general access account that you use only if you need to withdraw cash. Then you could have a bills account which has the exact amount of money you need for all of your fixed and regular costs. Then have a savings account and label it with whatever you are saving for.

Once your pay goes into the bills account, anything that exceeds the anticipated expenses for that fortnight should get transferred into the savings account. This should also include overflow savings from the previous fortnight. Make sure you are also leaving a buffer in the bill account to allow for your expenses that are not a fixed amount, which are usually costs from the category that can be eliminated but that you may still spend money on from time to time.

Frequent Flyer Savvy

If you are really savvy, then you may be taking advantage of frequent flyer credit cards. In that case you will just put all of your expenses on the credit card to earn the points, and then transfer the money from your bill account to the credit card account as the expenses come out. You don’t want to be using the credit card to live off, only to earn the points.

This is something I did for quite some time before my big trip. I managed to score three international flights on points purely from using this process. This would not be ideal for someone who already has a lot of existing debt. And you certainly should not be paying any interest. If so, then you are defeating the purpose of gaining the frequent flyer benefits. At that point, the card is really just another expense. As with the rest of my steps here, I am not a financial advisor and am not recommending a frequent flyer credit card to you. I am just stating that this is a process I have used to receive extra benefits when saving money.

Step 7 – Make Sure Your Goal is Clear

The final step which I find really helps to keep you on track and focused on your goal is to know exactly what it is you are saving for. Just saving for the sake of saving and without a deadline can be a really challenging and draining endeavour. This is usually what causes most people to give up and fall back into old habits. Living like a uni student or a backpacker for an indefinite period of time is not really ideal. Having an end date in sight and knowing what the reward will be will make it a lot easier to get through the hard times.

You need to clearly identify whatever it is you are trying to save for. You need to know exactly how much you need to make that dream a reality. Lastly, you need to reiterate and enforce how important that goal is to you. That may be in a mental way, on a physical vision board or just by completing daily affirmations and talking about it to friends and family. By doing all of these steps to clarify your goals, it will become a lot easier to persevere through the tough times and make it to the finish line.

Eliminating Debt and Liabilities

This Process Can Still Work for You

If you are someone who has existing debt and liabilities that you are struggling to pay off, that are accruing interest and that you feel like you will never pay off; this guide can still be useful to you. You may just need to implement some additional steps, add in more time to your savings plan and be a little more brutal when it comes to where your money is going.

Additional Steps

What I would recommend is working out exactly how much you owe on each of your debts. Then work out which liabilities are accruing the most interest and are growing the quickest. Also work out which ones are not having that much of an impact and can be left the longest, and also any that can be eliminated easily and with little cost but great reward. You will need to be a bit smarter in which debts you pay off first and how much you pay off each of the debts so going through this process can make a world of difference.

Once you have gone through the process of working out which debts would be the most beneficial to pay off first you are almost ready to go.

You then still need to follow all of the steps I highlighted above. So work out all of your expenses and costs and categorise them. The key though, is to leave all of your debts out of your above calculations. Focus on reducing your flexible and non-essential costs in anyway that you can. Then work out how much money you have coming in and out each fortnight to determine the leftover amount.

After you have worked out how much money you have leftover each fortnight you will be able to determine how much money you can put aside to go towards paying off your debts and reducing the amount of interest you are accruing. So instead of the leftover money going into a savings account, for you in the beginning this money will be going towards reducing and eventually eliminating all of your liabilities. Once you have achieved that first goal then you can move on to your savings goal.

It May be More Possible Than You Realise

You will soon realise that once you reduce all of your flexible and unnecessary living expenses that you will be able to pay off your debts a lot sooner than you realised. Having your debts ranked and working out how long it will take you to pay them off also allows you to see the light at the end of the tunnel. Suddenly a mountain of impossible debt is something that you can feasibly see yourself paying off. This is motivating and rewarding all at the same time.

Paying off your debts and eliminating them entirely will need to be your main focus and goal in the beginning, before you can look at working towards your big picture goal. You won’t be able to save effectively or efficiently if your debts are increasing. Eliminating them entirely needs to be your number one priority in the beginning. Being debt free will be a reward in and of itself, even without your next goal.

Join the Debt Free Club and Pursue Your Savings Goals

Once you have done that, you will be in the same position as anyone else who is debt free. It will obviously take you longer to get to this clean slate level and to begin saving than someone who has no debt, but it doesn’t mean it is impossible for you to save money and reach your goals. Once you get to the point of having no debt, all of that extra money will seem like such an enormous amount and you will feel on top of the world while you smash all of your savings goals.

It is Possible

Have Faith in the Process

So don’t be discouraged by your debts, your income or your personal circumstances. Don’t get caught up in the idea that you are terrible at saving money or that it is impossible for you to save money. In almost all occasions for people who are living in a developed country, with employment, you can reach your savings goals if you work hard at prioritising your goals and being aware of what it is you spend your money on.

How it Worked for Me

By prioritising travel and hiking as the most important aspects of my life last year I was able to easily say no to extra expenses that added no long term value to my life. I was able to save huge portions of my pay each fortnight and saw my savings grow exponentially at a faster rate than they ever have in my life.

I am not going to lie to you, it can be a difficult road at times. It can be especially frustrating to say no to certain things or to part ways with old habits. It can also be enlightening though to realise how much less you need to live a happy and fulfilling life.

When you cut out all of the extra expenses that were providing you with very few benefits and satisfaction, your purpose and aspirations then become a lot clearer. I feel a lot lighter, less stressed and more focused now that my life isn’t overcrowded by material possessions and wasteful expenses. You then realise you can either maximise your savings or live on less. Either of these options are great for your health and well-being.

My Process Now

A More Relaxed Goal

Last year, I removed all costs from my life that weren’t essential to survive or that didn’t contribute to my goal of travel and hiking. By reducing my expenses to basically nothing for so long I was able to work out what I really wanted to spend my money on. Being back home now, I have determined what flexible and non-essential expenses are still necessary to provide me with a good level of satisfaction in life. It was also easy to see what expenses and habits were of no benefit to me at all and that I still avoid to this day.

After reaching my savings goals and returning from my adventure I am on a much more relaxed savings plan. I still have the same approach though. My savings goal spreadsheet is still being used in the same way. The difference now is that I am not trying to save as much money in such a short amount of time. I have made allowances to spend money on recreational activities with friends, on my health and fitness, and on other areas of my life that I have realised I value enough to warrant spending money on.

I am still trying to maintain a more minimalist lifestyle though, as I believe it is not just healthy for my bank account, but also for my mind, body and soul. Here’s a good article and blog if you are interested in learning more about this way of life.

Finding Balance

I am still saving more effectively than I used to before I became more focused on what I was spending my money on. But I also have a healthy balance now of saving for a long term goal and still enjoying the moment I am currently in. This balance will be unique to your and your own savings goals and timeline. Just make sure your goals are realistic so they are achievable. You always want to feel like you are exceeding your savings goals, or at least meeting them. Failing to meet your targets on a regular basis because they were too unrealistic will always make the process more difficult on a mental level.

Hitting your Savings Goals

Good luck with your savings goals and I hope that this article has helped you realise how attainable your goals and dreams really can be. If you found this guide useful, please save it to Pinterest for later or share it on social media. If you have any questions, please feel free to leave a comment below or get in contact with me if you don’t feel comfortable asking questions about your savings plan on a public platform.

Has all this talk about savings got you ready to put your money to better use? Then check out these handy links to some of my favourite adventures and other helpful advice:

- Adventure Travel

- Solo and Long Term Travel

- Advice and Reflective Posts that Make You Think

- Why not start your own blog? Follow this step-by-step guide!

--Girl Seeking Purpose